Sephora Beauty Product Analysis

- Sofia Herrmann

- Dec 3, 2025

- 1 min read

Updated: Jan 7

Analyzed pricing and rating patterns across 40+ beauty products to identify consumer preferences and pricing sweet spots. Key Results: Discovered mid-range products ($20-40) achieve ratings comparable to luxury items

🎯 THE CHALLENGE Beauty brands often charge premium prices claiming superior quality. But do expensive products actually perform better? I set out to answer: "What's the real relationship between price and quality in the beauty industry?"

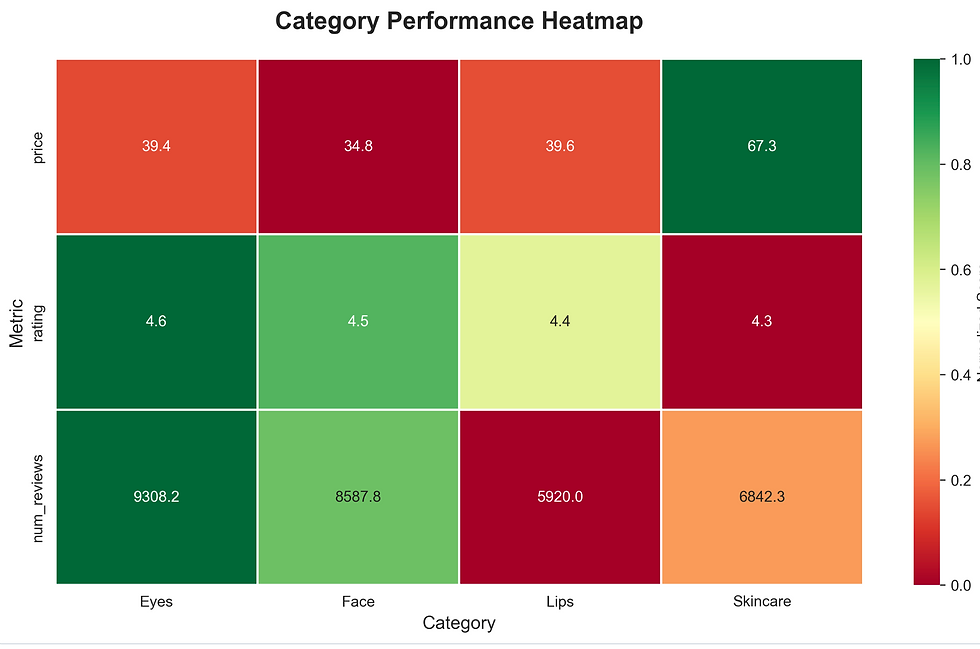

💡 THE APPROACH I analyzed 40+ Sephora products across 4 categories (Face, Eyes, Lips, Skincare), examining: - Price vs. rating correlations - Category pricing patterns - Brand positioning strategies - Value sweet spots

🔍 THE DISCOVERY The data revealed a surprising truth: price and rating have almost NO correlation (r=0.15). Some $20 products outperformed $70 luxury items in customer satisfaction. The real insight? The $20-40 range is the "sweet spot" where products achieve 4.5+ star ratings without premium pricing. Luxury products (>$70) don't deliver proportionally better ratings despite 3-4x higher prices. Even more fascinating: Skincare commands the highest prices, but makeup categories show the strongest rating consistency.

💼 WHY IT MATTERS For consumers: You're not sacrificing quality by buying mid-range. For brands: Premium pricing requires exceptional marketing, not just higher prices. For retailers: Stocking the $20-40 range maximizes customer satisfaction and purchase likelihood. This analysis challenges the "you get what you pay for" assumption in beauty retail.

📊 TECHNICAL SKILLS: Python, Pandas, Statistical Analysis, Data Visualization

[View Project] [GitHub →]https://github.com/bmatos3108/sephora-product-analysis/blob/main/sephora_rating_vs_price.png

Comments